No Income Rental/DSCR Loan

Purchase & Refinance for Investment Properties with Rental Income Only

What is a DSCR (Rental property) Loan?

A DSCR loan is a special type of mortgage for buying rental properties. Instead of looking at your personal income or job history, lenders use the property’s rental income to decide if you qualify.

DSCR stands for Debt Service Coverage Ratio. It shows whether the property makes enough money to pay the mortgage. To figure it out, lenders divide the property’s income (after expenses) by the loan payment.

If the property earns more than it costs to own, you’re more likely to get approved.

DSCR – Easy Cash Out Refinance

If you’re looking to cash out refinance your rental property without providing W-2s, pay stubs, or tax returns, DSCR (Debt Service Coverage Ratio) loans are a powerful and flexible option tailored for real estate investors like you.

“Let us help you unlock the equity in your rental property—quickly and hassle-free.”

- ✅ DSCR Loan Checklist for First-Time Buyers

- 1. Property Type

- Is the property a rental (short-term like Airbnb or long-term lease)?

- Is it expected to generate steady rental income?

- 2. Income Requirements

- You prefer not to use personal income or employment history to qualify.

- You have limited or variable income (e.g., self-employed, freelancer).

- 3. Property Income

- The property’s rental income is enough to cover the mortgage payment.

- You can provide a rental analysis or lease agreement.

- 4. Credit & Down Payment

- You have decent credit (usually 620+ is preferred).

- You can make a down payment (typically 20–25%).

- 5. Investment Goals

- You want to start or grow a rental property portfolio.

- You’re looking for a loan that focuses on property performance, not personal finances.

- 6. Loan Process

- You want a simpler, faster approval process.

- You’re okay with slightly higher interest rates in exchange for flexibility.

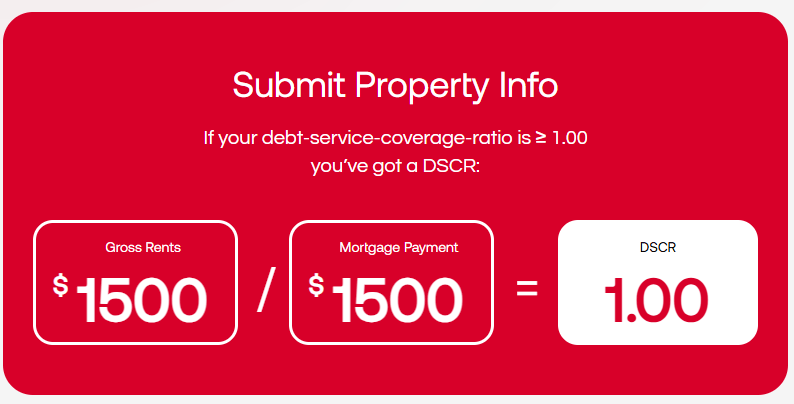

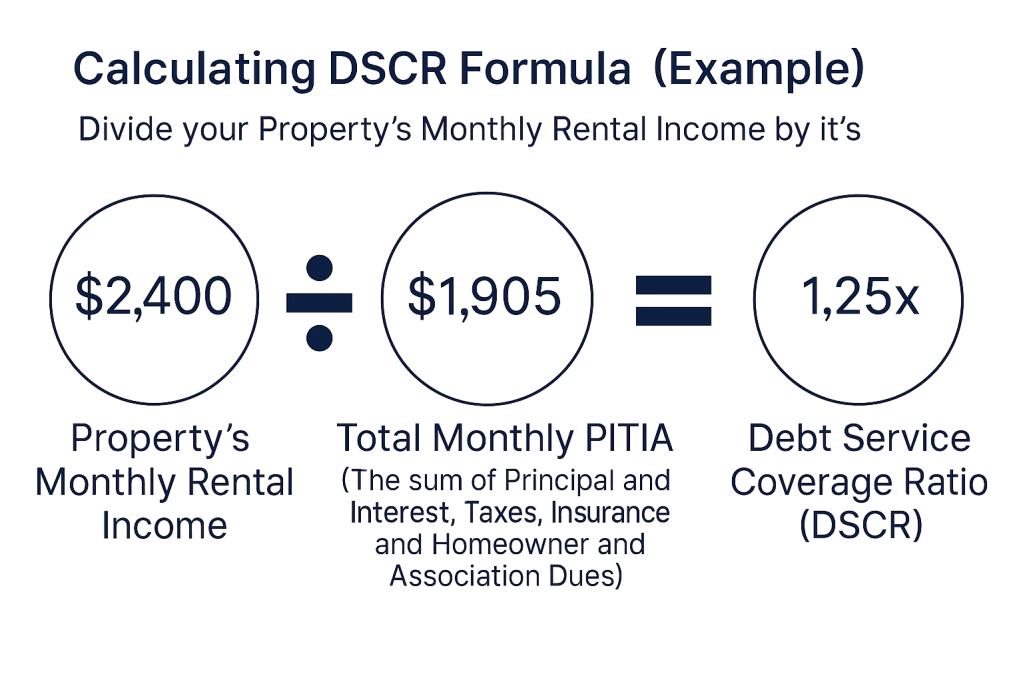

DSCR Calculation

DSCR=Gross Monthly Rent / Monthly Mortgage Payment (PITIA)

- Where PITIA is Principal, Interest, Taxes, Insurance, and Association dues(if applicable)

=Monthly Mortgage Payment (PITIA)Gross Monthly Rent

Example Rent Divided PITIA (RDP)

$1100 rent / $1000 PITIA = 1.10% DSCR Positive Cash Flow

$1000 Rent / $1000 PITIA = 1.00% DSCR 1 to 1 Break Even

$900 Rent / $1000 PITIA = .90% DSCR Negative Cash Flow

Rental Income: Rental income can be determined from:

-For short-term rentals, 12-month rental history

-Lease agreement

-Market rent (Form 1007) Provided by the appraiser

LLC Closing Requirements for DSCR

- Required Documents for LLC Closing:

- Articles of Incorporation or Articles of Organization

- Operating Agreement

- Tax Identification Number (EIN)

- Certificate of Good Standing

- Fully executed Certification Regarding Beneficial Owners

- Valid ID for non-borrowing LLC owners

- LLC’s Certificate of Borrower and Authorization

- LLC Ownership Restrictions:

- Maximum of 4 individual owners

- Borrowers must own a total of 51% of the business entity

- Primary borrower must be:

- A manager or

- Majority owner (25% or greater)

- Ownership percentage cannot have changed within 90 days of application

Example Scenario:

- Property Monthly Rental Income: $2,000

- Monthly PITIA: $2,000

Calculation: $2,000 (Rental Income) ÷ $2,000 (PITIA) = 1.0 DSCR

This means the property’s rental income exactly covers its mortgage-related expenses.

A DSCR of 1.0 means the rental income exactly covers the monthly mortgage payment. This is typically the minimum threshold most lenders require to approve a DSCR loan.

Purchase with Only 20% Down Payment

- Max LTV: 80%

- FICO: 640+

- Rental Calculation:

- Long-Term Lease: 100% of Lesser of Market Rent or Lease Amount

- Unleased: 100% of Market Rent

- Short-Term Rental: 100% of Market Rent

Cash-Out up to 75%

- Max Loan Size: $2,500,000

- DSCR Requirement: ≥ 1.00

- Max LTV/CLTV:

- 75% at 700 FICO

- 70% at 680 FICO

- Minimum Reserves: 3 months

- Cash Out Proceeds Limitations:

First-time homebuyers not allowed

Manufactured homes not permitted

Maximum property size: 20 acres

Up to 20 financed properties allowed

Uses lower of Form 1007 or lease agreement

.

.

We’re hiring and training driven individuals to become successful mortgage loan officers. Whether you’re new to the industry or looking to grow, we provide the tools, mentorship, and support to help you thrive.

“Farm and commercial loans made easy — we search a wide network of lenders to match your unique needs.”

Mortgage Broker, California

Get In Touch

info@RocklinBroker.com

(916) 516-1116

MAC Real Estate Services 5701 Lonetree Blvd, Suite 126 H Rocklin CA 95765

DRE 01800662 NMLS 1133016

Opening Hours

Mon-Fri

10 am — 5 pm

Sat, Sun

Closed